Career as an Actuary in India 2023: Careers and Opportunities

- Naief Khatri

- Updated Date: August 16, 2023

Table of Contents

The field of actuarial science in India is slowly gaining popularity and recognition in India. The scope of Actuary in India is bright. Career as an actuary in India involves application of math, statistical knowledge, skill in risk assessment, and evaluation of financial products such as insurance and investments. We interacted with Khushwant Pahwa, a consulting actuary, with over 10 years of work experience.

According to him, actuaries are expected to have a detailed understanding of economic, financial, demographic, insurance risks; and possess expertise in developing & using statistical & financial models to inform financial decisions. Actuaries would know all about pricing, establishing the amount of liabilities, and setting capital requirements for uncertain future events. In this article we are going to discuss how to become an actuary in India, career in actuarial science, actuary qualifications, actuary exams in India, how many papers in actuarial science to give, actuarial science courses in India and many more things.

Also Read: Career as a Forest Ranger

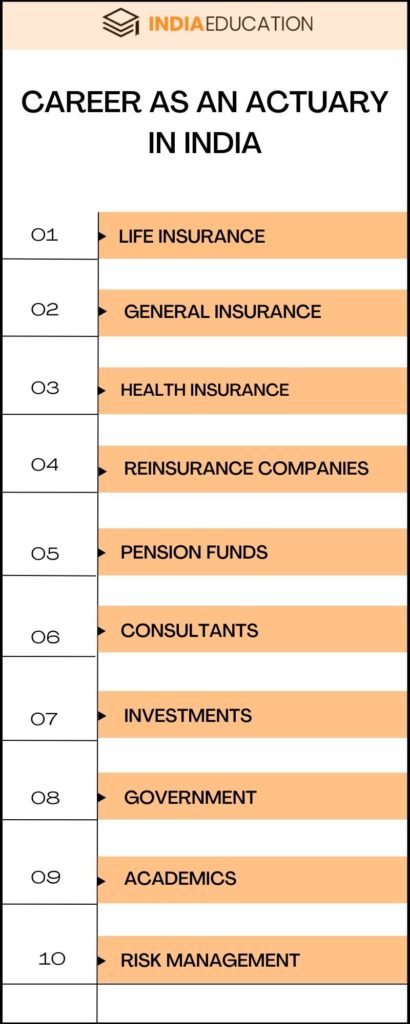

Career Opportunities 2023

An actuary in India typically works in the following fields. Here is a list of actuaries in India:

- Life Insurance

- General Insurance

- Health Insurance

- Reinsurance Companies

- Pension Funds

- Consultants

- Investments

- Government

- Academics

- Risk Management

The role that an actuary can perform in each of these sectors can be quite varied, such as product pricing, financial modelling, valuations, risk management, carrying out peer reviews, designing social security schemes, advise on the premium to be charged etc.

“In terms of availability of opportunities in the immediate future, I see more openings coming up in general insurance companies, health insurance companies, actuarial consulting firms (including some of the Big 4 providing actuarial services) as well as actuarial back offices (such as WNS, Mercer etc). I expect life insurance companies to have a relatively lower intake of fresh actuarial resources over the next couple of years.

Outside of India, I see huge demand for actuaries in both the developed as well as emerging markets. I see lack of supply particularly in emerging markets such as Indonesia, Thailand, Vietnam, Cambodia, African Countries..” says Pahwa who has worked in diverse actuarial areas viz employee benefits, life insurance, general insurance and is founder & consulting actuary at KPAC (KP Actuaries and Consultants). He is also serving as Chief and Appointed Actuary at Iffco Tokio General Insurance.

Some of the companies that hire actuaries in India include Max Bupa Health Insurance, WNS, Towers Watson, PwC Actuarial Services India, Mercer, Directorate of Postal Life Insurance, McKinsey Advanced Healthcare Analytics, E&Y, Milliman, Swiss Re, Future Generali, IDBI etc.

How to become an Actuary: Actuary Courses in India 2023

The Institute of Actuaries of India (IAI) regulates the education & training of actuaries in India. When a student becomes a member of IAI by clearing the ACET exam [Read: All about “Actuarial Common Entrance Test” (ACET)], it is understood that he possesses the skills required to become a successful actuary. What to do after the ACET exam is discussed below:

Following are the eligibility criteria to become an actuary and for doing an actuarial science course in India:

- 10+2(H.S.C) or equivalent

or - Graduate or Post Graduate in Mathematics, Statistics, Economics, Computer Science, Engineering, MBA (Finance) and other similar qualifications.

or - Fully qualified members of professional bodies such as:

- The Institute of Chartered Accountants of India

- The Institute of Cost and Works Accountants of India

- Certified Institute of Financial Analysts of India

- Fellow of Insurance Institute of India

- Highly proficient in mathematics & statistics

After clearing ACET, you can apply online (www.actuariesindia.org/Admission_login.aspx) to become a student member of IAI.

Khushwant Pahwa explains further, “To become an actuary, you need to pass all actuarial exams (15 of them!) and have 3 years of practical work experience. Passing exams will require students to have application skills as just mugging up the study material will not make them pass exams (certainly not some of the higher level exams). Actuarial science in India is a distant learning program (just like chartered accountancy). One shall have to study on his / her own. There are, though, some coaching institutes which provide coaching for actuarial subjects.”

Also Read: Mass Communication Careers in India

Career as an Actuary in India : Actuarial exams in India by IAI

In order to make a career as an actuary in India and become an actuary, a person need to pass all the actuarial science exams. There are 15 actuarial exams conducted by IAI include 9 written exams and 3 practical exams; Here is the actuarial papers list:

Stage 1: Core Technical (CT)

You have to either pass all these 9 exams:

| CT1 | Financial Mathematics |

| CT2 | Finance and Financial Reporting |

| CT3 | Probability and Mathematical Statistics |

| CT4 | Models |

| CT5 | General Insurance, Life and Health Contingencies |

| CT6 | Statistical Methods |

| CT7 | Business Economics |

| CT8 | Financial Economics |

| CT9 | Business Awareness Online Module (Practical Exam) |

Stage 2: Core Application (CA)

You have to pass all these 3 exams:

| CA1 | Actuarial Risk Management |

| CA2 | Model Documentation Analysis and Reporting (Practical Exam) |

| CA3 | Communication (Practical Exam) |

Stage 3: Specialist Technical (ST)

At this stage you can specialize and choose any 2 subjects out of the 6 offered:

| ST1 | Health and Care |

| ST2 | Life Insurance |

| ST3 | Pension and Other Employee Benefits |

| ST4 | Finance and Investment A |

| ST5 | Finance and Investment B |

| ST6 | General Insurance Reserving and Capital Modeling Specialist Technical |

| ST7 | General Insurance Pricing Specialist Technical |

| ST8 | Enterprise Risk Management |

Stage 4: Specialist Application (SA)

You can choose any 1 subject (preferably corresponding to the ST subjects you chose):

| SA1 | Health and Care |

| SA2 | Life Insurance |

| SA3 | General Insurance |

| SA4 | Pension and Other Employee Benefits |

| SA5 | Finance |

| SA6 | Investment |

Once you clear all the 9 CT papers & all the 3 CA papers, you are eligible to become an Associate Member of the IAI. And once you clear all the 15 papers you can become a Fellow Member of the IAI. As of March 2015, there are only 290 Fellows, 158 Associates and 9846 Student Members of the IAI.

Career as an actuary in India is tough and only the most skilled professionals clear all the levels. Many students often quit studying after clearing a few exams as there are job opportunities even if you’ve cleared 2-3 papers of the IAI. The industry is therefore facing a resource crunch for highly qualified actuaries.

Also Read: Modeling as a Career Option

A day in the life of an Actuary

Image courtesy: www.actuariesindia.org

Career as an Actuary in India: Skills Required

Actuaries are expected to be good at mathematics, statistics and possess good modeling skills. However, these are what actuaries are ‘supposed’ to be. As per me, to be successful, actuaries need to be more business savvy, be commercially sound have good communication skills.

Actuaries, being mathematicians / statisticians, are often introverted or not very good at communicating with non-technical people. This is one area where actuarial students need to improve, feels Pahwa.

Also Read: Film and Video editing Career in India

Career as an Actuary in India: Actuarial Science Salary in India 2023

The scope of actuarial science in India is bright. According to Pahwa who’s been in this industry for 10 years, a newly qualified actuary today does not earn less than Rs. 15 to 20 lakhs. The salary of experienced actuaries is much more.

Actuarial students can expect to start their career with an annual package of anywhere between Rs.4 to 5 lakh.

Career as an Actuary in India: Top Colleges/Institutes for Actuarial Science

Apart from clearing the 15 actuarial exams of the Institute of Actuaries of India (IAI), it is advisable to join a regular bachelors/ masters course in the relevant field. A course like an M.Sc/ MBA in Actuarial Science covers the syllabus of all the CT papers and if considered a better option than going for coaching/ self-study.

| No. | College/Institute | Courses/Degree Offered |

| 1 | Amity School of Actuarial Science – Noida | B.Sc (Actuarial Science) B.A. Hons. (Insurance & Banking) MBA – Insurance & Financial Planning MBA – Insurance & Banking M.Sc. (Actuarial Science) |

| 2 | Christ University – Bengaluru | M.Sc. Actuarial Science |

| 3 | Bishop Heber College – Tiruchirappalli | B.Sc. (Actuarial Mathematics Science) M.Sc. Actuarial Science P.G. Diploma (Actuarial Science) |

FAQ's

Applicants with prior technical training in areas like pricing management, data analysis, etc. should expect to make more money than those with more general abilities. The remuneration package for a candidate with more than 10 years of experience might go up to INR 14 LPA. The maximum pay for actuaries is INR 50 LPA and higher.

Actuaries’ employment is expected to increase by 21 percent between 2021 and 2031, which is substantially faster than the average for all occupations. Over the next ten years, there are expected to be, on average, 2,400 opportunities for actuaries. One need to clear all the actuaries papers to become an actuary. The total actuary in India is 458.

Actuarial fellow positions in the field of property and casualty insurance often offer the highest salaries, followed by actuarial science positions in other sectors of the industry, such as life, health, and pension.

The no. of total actuaries in India is 458.

Actuary courses are courses which helps in the preparation and training of actuaries exams. There are many actuary courses in India which help us to prepare for actuarial papers. The actuaries course details for different courses can be found online.

There are 15 actuary/actuarial science papers one needs to give to become an actuary.

To become an actuary one needs to pass all the actuarial science exams. There are enough jobs available for an actuary in India and actuary career in India is bright. The actuarial salary in India is also very good.

The Actuarial Science syllabus is divided into 4 stages/levels which are listed above.

To prepare for the actuarial services exam one can study from books or take actuarial courses in India. There are many actuaries course available including actuarial valuation courses, insurance actuary courses and many more. Actuary course details can be found online.

After passing the ACET exam you become eligible for the student membership of the IAI.