Difference Between CA And ICWA 2023: Fees, Syllabus and more.

- Naief Khatri

- Updated Date: August 23, 2023

Table of Contents

Difference between CA and ICWA. The general opinion is that CA is tougher than the course in Cost Accountancy organized by ICWA (Institute of Cost and Work Accountants of India) now known as ICAI (Institute of Cost Accountants of India). While this may be true, CA ICWA the option to pursue a combination of both courses is also open for people but you can practice only one of the two. If you are serious about pursuing a career in accountancy, you should know the ICWA and CA difference it is also important to understand how these two qualifications differ, and what would be the best option for you if you have just finished your 12th standard.

Difference between CA Vs ICWA salaries. The salaries of ICWA vs CA professionals vary depending on their experience, skills, and location. However, in general, CAs tend to earn higher salaries than ICWAs. the average salary of a CA in India is ₹6.5 lakhs per year. The highest salaries are in the financial services sector, where CAs can earn up to ₹10 lakhs per year.

The average ICWA salary in India is ₹4.5 lakhs per year. The highest salaries are in the public sector, where ICWAs can earn up to ₹6 lakhs per year.

If you are wondering about CA and ICWA differences the then this article will brief you on the same.

Difference between CA and ICWA

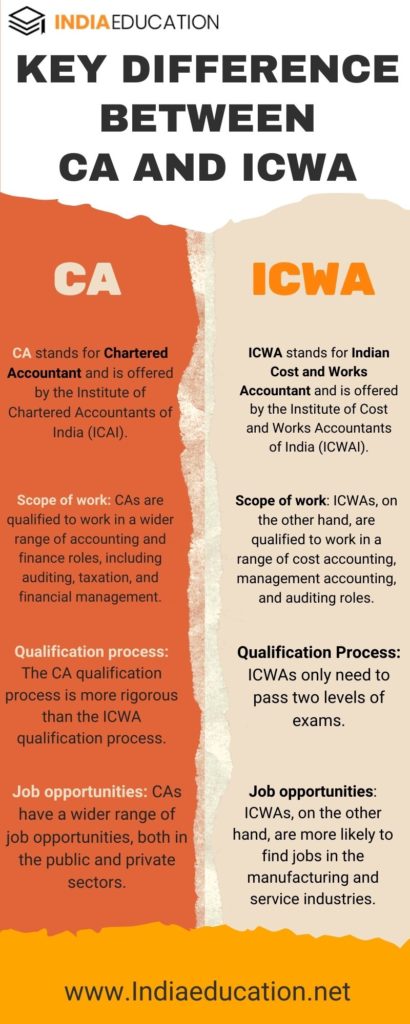

Here are some of the key differences between CA and ICWA:

CA stands for Chartered Accountant and is offered by the Institute of Chartered Accountants of India (ICAI).

ICWA stands for Indian Cost and Works Accountant and is offered by the Institute of Cost and Works Accountants of India (ICWAI).

Difference between Ca and Icwa both are professional accounting designations that are offered in India. However, there are some key differences between the two designations.

- Scope of work: Difference Between CA And ICWA, CAs are qualified to work in a wider range of accounting and finance roles, including auditing, taxation, and financial management. ICWAs, on the other hand, are qualified to work in a range of cost accounting, management accounting, and auditing roles.

- Qualification process: Difference Between CA And ICWA ,the CA qualification process is more rigorous than the ICWA qualification process. CAs must pass three levels of exams, while ICWAs only need to pass two levels of exams.

- Job opportunities: Difference Between CA And ICWA are CAs have a wider range of job opportunities, both in the public and private sectors. ICWAs, on the other hand, are more likely to find jobs in the manufacturing and service industries.

- Salary: Difference Between CA And ICWA salaries are CAs tend to earn higher salaries than ICWAs.

- Reputation: CA is a more well-known and respected designation than ICWA.

Ultimately, the best way to decide which designation is right for you is to consider your career goals and interests. Talk to professionals in both fields and do your research to learn more about the different career paths that are available.

Chartered Accountants (CA) Vs. Cost & Management Accountants (CMA/ CWA)

Generally, an MBA in Marketing Management is a 2 years full time degree. Some institutes may offer distance learning opportunities. Besides the core topics, aspects that are broadly taught are the following,

- Consumer Behavior

- Advertising Management

- Competitive Marketing

- Business Marketing

- Sales Force Management

- Service Marketing

- Sales Promotion Management

- Product and Brand Management

- Internet Marketing

- Retailing Management

- Marketing Channel

- Analytical Marketing

- Advanced Research Techniques in Marketing

- Marketing Communications Management

- Customer Relationship Marketing

Instructors may choose from several modes of education like, discussion, case studies, computer based simulations, projects, presentations, video conference, e-learning etc. You may also get to gain practical experience from internships. Here are the key difference between ICWA and CA.

Chartered Accountants (CA) Vs. Cost & Management Accountants (CMA/ CWA)

CA | CMA/ CWA |

| Definition: Chartered Accountancy (CA) is one of the most prestigious qualification in accounting and can be pursued immediately after your 12th standard exams. A qualification in Chartered Accountancy equips a student with thorough knowledge of auditing, taxation and accounting. | Definition: A Cost Accountant is expected to collect, assimilate, collate, and analyze financial information from all areas of the organization. A cost accounting degree equips you with the knowledge on how to manage finance competently. Cost Accountancy as a profession is developed and improved by the ICWA now known as the ICAI |

Governing Institute: It is important for students to register with the Institute of Chartered Accountants of India (ICAI) to appear for the examination. (Also read: All about the career of a CA) | Governing Institute: The Institute of Cost Accountants of India (ICAI) [previously known as the Institute of Cost & Works Accountants of India (ICWAI)] promotes, regulates, and develops the profession of Cost & Management Accountancy in India. (Also read: All about the career of a CMA) |

Levels of Chartered Accountancy:

| Levels of Cost Accountancy: There are 2 levels that need to be passed after the foundation course:

|

Eligibility Details: If you have passed 10+2 from any stream from a recognized school, you are eligible to apply for the Common Proficiency Test (CPT). If you registered for the Common Proficiency Test 60 days prior to the first day of the month in which CPT examination is to be held, you can appear in the examination. You need to apply on or before 1st April and 1st October to appear for CPT examination to be held in June and December respectively. | Eligibility Details: Eligibility for admission to “foundation” level: passed Class 10 or equivalent from a recognized Board or Institution. Eligibility for admission to “intermediate” level: Passed Senior Secondary School Examination (10+2) & Foundation Course of CMA (ICAI)/ Graduation in any discipline other than Fine Arts/ Foundation (Entry Level) Part I Examination of CAT of the Institute/ Foundation (Entry Level) Part I Examination and Competency Level Part II Examination of CAT of the Institute OR Passed Foundation of ICSI/Intermediate of along with 10+2. Exams are held twice a year – June & December |

Membership Requirement: To apply for membership to Institute of Chartered Accountancy of India, you need to pass the final course examination and also finish the requisite work experience. | Membership Requirement: Nothing prescribed |

Job Profile: A Chartered Accountant (CA) has thorough knowledge of every aspect of accounting, auditing and taxation.

| Job Profile: A Cost & Management Accountant (CMA) has knowledge of cost & financial management to ensure a balance between expenditures & available resources.

|

Career Prospects:Chartered accountants are involved in a variety of roles. They are either employed by a company or are practicing chartered accountants. They are involved in:

Quality chartered accountants are always in high demand. Demand for professionally qualified accounting personnel who can advise on cost control and financial investments are always high. As a fresher, you will start your career as an internal auditor or as a team member in the finance department of an organization. Salary: According to Payscale, an entry-level chartered accountant can expect an average salary of INR 6.42 LPA. | Career Prospects: Every organization needs a good cost accountant. You can also take up consultancy work with various firms. With experience and training, cost accountants can hold top management positions like Financial Controller, Chief Accountant, Cost Controller, Marketing Manager, and Chief Internal Auditor. Options are also open for CMAs (previously CWAs) to directly register in M.Phil and Ph.D. courses in commerce as decided by the Association of Indian Universities. All India Council for Technical Education or AICTE also accept fellow members of ICWAI as at par with persons holding Ph.D. degree. They are, therefore, eligible for appointment to the posts of Professor and Lecturer in Professional and management Institutes. Salary: According to Payscale, the average pay for an entry-level CWA is INR 4 Lakh

|

CA and ICWA which is better

ICWA or CA which is better the choice between CA and ICWA depends on your career goals and interests.

- CA stands for Chartered Accountant. It is a professional accounting designation that is awarded by the Institute of Chartered Accountants of India (ICAI). CAs are qualified to work in a wide range of accounting and finance roles, including auditing, taxation, and financial management.

- ICWA full form is Indian Cost and Works Accountant. It is a professional accounting designation that is awarded by the Institute of Cost and Works Accountants of India (ICWAI). ICWAs are qualified to work in a range of cost accounting, management accounting, and auditing roles.

Here is a table comparing the two qualifications:

Qualification | Eligibility | Exams | Scope of Work |

Chartered Accountant (CA) | Graduate degree in any discipline | 3 levels of exams | Auditing, taxation, financial management, corporate finance, investment banking, consulting, etc. |

Indian Cost and Works Accountant (ICWA) | Graduate degree in any discipline | 3 levels of exams | Cost accounting, management accounting, auditing, taxation, etc. |

difference between chartered accountant and cost accountant

some of the key difference between cost accountant and chartered accountant, cost accountant vs chartered accountant Scope of work: CAs are qualified to work in a wide range of accounting and finance roles, including auditing, taxation, and financial management. Cost accountants, on the other hand, are qualified to work in a range of cost accounting, management accounting, and auditing roles. Here are some cost accountant and chartered accountant difference.

- Qualification process: The CA qualification process is more rigorous than the cost accountant qualification process. CAs must pass three levels of exams, while cost accountants only need to pass two levels of exams.

- Job opportunities: CAs have a wider range of job opportunities, both in the public and private sectors. Cost accountants, on the other hand, are more likely to find jobs in the manufacturing and service industries.

- Salary: CAs tend to earn higher salaries than cost accountants.

- Reputation: CA is a more well-known and respected qualification than cost accountant.

These are key difference between chartered accountant vs cost accountant

FAQS

In India, an Icwa makes an average pay of 4 Lakhs per year, or $33.3k per month. Salary projections are based on the 12 most recent wages from different Icwas across sectors. What is the ICWA’s beginning pay in India? Icwa beginning salaries in India typically range from 1.4 lakh to 11.7 lakh rupees (per year).

You can begin your job as a cost accountant once you have finished the ICWA course. Holders of an ICWA degree are widely sought after in the public sector, private businesses, development organizations, banking & finance sectors, and education & training sectors

In India, the average icwa pay is 260 per hour, or 650,000 annually. The starting salary for entry-level employment is 500,000, while the average yearly salary for experienced professionals is 1,320,000.

here are the full forms of CA/CS/CWA and ICWI:

- CA full form: Chartered Accountant

- CS full form: Cost Accountant

- CWA form: Cost and Works Accountant

- ICWI form: Institute of Cost and Works Accountants of India

The ICWA degree course is a professional accounting course that is offered by the Institute of Cost and Works Accountants of India (ICWAI). The course is designed to provide students with the skills and knowledge they need to work in a range of cost accounting, management accounting, and auditing roles. ICWA course fees are generally around INR 10,000 to INR 20,000 per level.

ICWA course details:

- The ICWA course is a professional accounting course that is offered by the Institute of Cost and Works Accountants of India (ICWAI).

- The course is designed to provide students with the skills and knowledge they need to work in a range of cost accounting, management accounting, and auditing roles.

- The ICWA course is divided into three levels: Foundation, Intermediate, and Final.

- The subjects covered in the ICWA course include:

- Basic accounting

- Cost accounting

- Management accounting

- Auditing

- Taxation

- Financial management

The ICWAI’s mission is to promote the science and practice of cost and works accounting and to provide high-quality professional education and training to its members. The ICWAI’s vision is to be the leading professional body for cost accountants in the world.

ICWA Meaning Indian Cost and Works Accountant.

CWA and CMA are both professional accounting designations that are offered in different parts of the world.

- CWA stands for Cost and Works Accountant and is offered by the Institute of Cost and Works Accountants of India (ICWAI).

- CMA stands for Certified Management Accountant and is offered by the Institute of Management Accountants (IMA).

Both CWA and CMA are rigorous qualifications that require a significant amount of study and effort.

- There are a wide range of career opportunities available to ICWAs. They can work in a variety of industries, including manufacturing, service, and government. Some of the common job roles for ICWAs include:

- Cost accountant

- Management accountant

- Auditor

- Financial analyst

- Business consultant

- There are a wide range of career opportunities available to ICWAs. They can work in a variety of industries, including manufacturing, service, and government. Some of the common job roles for ICWAs include:

Articles Updates:

13/07/2023: Content update, Interlinking

13/07/2023: Added Faq and infographic